Daily privacy-focused cryptocurrency activity just jumped by 1,300% in a matter of weeks. That’s not a typo. I’ve been tracking network metrics for years.

This kind of surge doesn’t happen without something fundamental shifting beneath the surface.

The numbers tell a compelling story. The network experienced a 10% price increase in 24 hours. Trading pushed around $623 with a market cap hitting $10.2 billion.

That’s enough to overtake Bitcoin Cash and claim the 18th spot among all cryptocurrencies.

What caught my attention wasn’t just the price action, though. Daily encrypted ZEC transactions spiked to 73,862 on November 13. This compared to roughly 3,000 per day before October.

The privacy pool grew from 18% to 23% of total supply by Q4 2025. Real users are demanding real privacy. Institutional backing from platforms like Binance is making it happen.

This isn’t speculative hype. It’s actual network utility increasing dramatically.

Key Takeaways

- Privacy cryptocurrency daily activity surged 1,300% from pre-October averages of 3,000 to 73,862 on November 13

- Network token price increased 10% in 24 hours, reaching approximately $623 with $10.2 billion market capitalization

- Privacy pool expanded from 18% to 23% of total coin supply between October and Q4 2025

- Market ranking improved to 18th largest cryptocurrency, surpassing Bitcoin Cash

- Institutional support from major exchanges and technology firms driving adoption momentum

- On-chain metrics indicate genuine utility growth rather than speculative trading patterns

Understanding Zcash and Its Shielded Transactions

Zcash’s architecture is unlike anything else in the crypto space. The Zcash privacy protocol works differently than you might expect. I first encountered Zcash back in 2017 and didn’t fully appreciate how different it was.

This isn’t just another cryptocurrency with privacy features tacked on. Privacy is the core design principle from the ground up. That fundamental difference matters more than you might think.

What is Zcash?

Zcash launched in October 2016 as the first practical application of zero-knowledge cryptography. The team included impressive cryptographers who wanted to solve a problem Bitcoin couldn’t: true financial privacy.

Bitcoin transactions are pseudonymous—you can see every transaction on the blockchain. Zcash gives you the option for complete privacy. That choice is important, and we’ll explain why soon.

The cryptocurrency uses Zcash zero-knowledge proofs to enable transactions where sender, receiver, and amount remain hidden. The network can still verify that the transaction is valid. No one can create coins out of thin air.

How Do Shielded Transactions Work?

The magic behind Zcash’s privacy is called zk-SNARKs privacy technology. It stands for “Zero-Knowledge Succinct Non-Interactive Argument of Knowledge.” The concept is actually pretty elegant once you break it down.

Imagine proving you know the solution to a puzzle without showing the solution itself. That’s essentially what zero-knowledge proofs do. You can prove a transaction is legitimate without revealing who sent it or how much.

Zcash operates with a two-tier address system. Transparent addresses (starting with “t”) work like Bitcoin—everything’s visible on the blockchain. Shielded addresses (starting with “z”) use Zcash zero-knowledge proofs to encrypt transaction data.

The zk-SNARKs privacy technology creates a mathematical proof that gets verified by network nodes. They confirm the transaction follows all the rules without seeing actual details. It’s cryptographic verification without exposure.

Shielded transactions take slightly longer to process—maybe 30-60 seconds versus near-instant transparent ones. That trade-off gets you genuine privacy that’s practically impossible to break with current technology.

Benefits of Using Shielded Transactions

Why would someone choose shielded over transparent transactions? The advantages go beyond just hiding your business, though that’s certainly part of it.

Financial privacy is the obvious first benefit. You wouldn’t want your bank statement posted on a public bulletin board. Many people don’t want their crypto transactions tracked by employers, competitors, or random strangers.

The Zcash privacy protocol normalizes privacy as a default right. It’s not something only criminals need.

Fungibility means all coins are equal. With Bitcoin, coins can be “tainted” by their history. If your Bitcoin was previously used in something illegal, some exchanges might flag it.

With shielded Zcash transactions, there’s no visible history. Every ZEC is identical to every other ZEC.

Protection from surveillance is increasingly relevant too. Companies are building entire businesses around tracking crypto transactions and selling that data. Shielded transactions make that surveillance impossible.

Zcash’s design includes the selective disclosure feature. You can prove transaction details when you need to—say, for tax compliance or an audit. You generate a viewing key that reveals specific transaction data to specific parties.

This addresses one of the biggest criticisms of privacy coins. The technology isn’t about enabling crime; it’s about giving legitimate users expected privacy. You have privacy by default, but transparency when legally required.

The two-tier system means businesses can choose their level of exposure. A company might use transparent addresses for verified business transactions. They can keep strategic financial moves private through shielded addresses.

That flexibility is something I haven’t seen implemented as elegantly anywhere else in crypto.

Recent Trends in Zcash Transactions

The data shows us important changes happening with Zcash right now. The network has experienced major shifts over recent months. Clear patterns emerge that reveal where this cryptocurrency is headed.

Network activity growth connects directly with increased interest in privacy features. This makes sense given digital surveillance and financial transparency concerns today.

Network Activity Explosion

Transaction volume growth on the Zcash network has been absolutely explosive. On November 13, 2025, daily transactions hit 73,862. This number seemed like a data error at first, but it wasn’t.

This represents a 1,300% increase from the pre-October baseline. Before this surge, the network processed around 3,000 transactions per day. Then something shifted dramatically.

This wasn’t a gradual climb. The spike happened quickly, suggesting specific catalysts rather than organic growth alone.

The sustained nature of elevated activity points toward real usage. We’re not seeing the typical drop-off that follows pump-and-dump schemes.

Privacy Adoption Metrics

Statistics on private ZEC transfers reveal interesting user behavior patterns. The shielded pool grew from 18% to 23% of total supply. This happened between October and Q4 2025.

That five percentage point increase represents significant capital choosing the privacy route.

Zcash (ZEC) shielded transactions require more computational resources and slightly higher fees. Users actively opt into complexity for privacy benefits. This indicates genuine demand rather than passive default behavior.

The price action accompanying these network changes is equally notable:

- 10% increase in 24-hour trading periods

- 29.05% weekly price gain during peak activity

- 66.55% monthly rise overall

- Trading around $623 per ZEC

- Market capitalization reaching $10.2 billion

These figures show market participants responding to increased utility and adoption signals. The correlation between network activity and price appreciation isn’t perfect. However, the directional alignment is clear.

Standing Among Privacy Competitors

How does Zcash compare against other privacy-focused cryptocurrencies and mainstream transparent chains? The comparison provides essential context for understanding this growth.

Zcash’s rise to become the 18th largest cryptocurrency by market cap matters. It overtook Bitcoin Cash during this period. This represents a notable shift in market preference toward privacy features.

Monero makes all transactions private by default. Zcash offers optional privacy. The fact that 23% of ZEC supply sits in the shielded pool shows users actively choosing privacy.

| Cryptocurrency | Privacy Model | Recent Growth Rate | Transaction Costs |

|---|---|---|---|

| Zcash | Optional privacy (shielded) | 1,300% volume increase | Moderate |

| Monero | Default privacy | Steady baseline | Low |

| Bitcoin | Transparent | Modest growth | Variable (high during congestion) |

| Ethereum | Transparent | Moderate growth | High (gas fees) |

Bitcoin provides pseudonymity and Ethereum focuses on smart contract functionality. Zcash (ZEC) shielded transactions offer true cryptographic privacy for those who want it.

The adoption rate trajectory suggests users increasingly value this privacy option. The current momentum is undeniable.

People aren’t stumbling into shielded transactions accidentally. They’re seeking them out despite the additional complexity. That behavioral pattern tells us something important about evolving priorities in the cryptocurrency space.

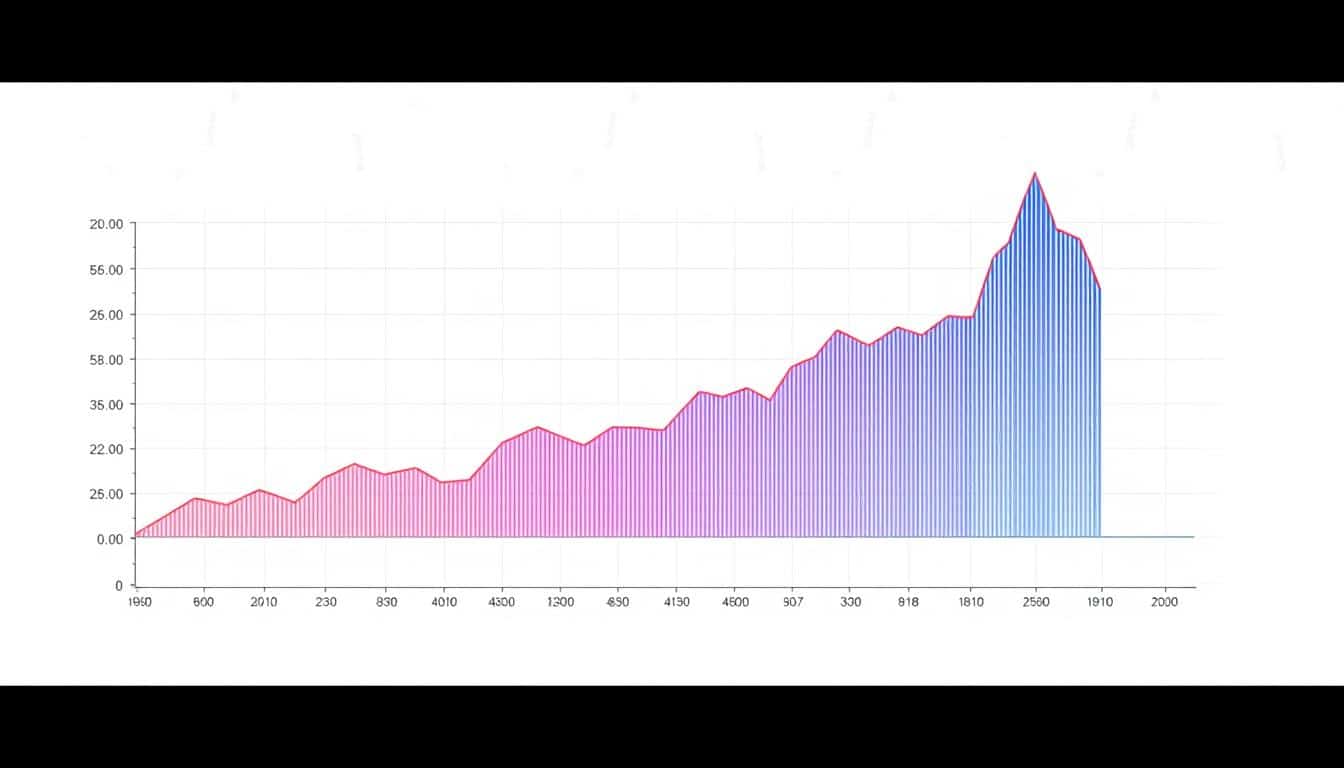

Graphical Representation of Zcash Data

Graphical representations of Zcash blockchain confidentiality metrics change how we understand adoption. Raw numbers tell you what happened, but charts show you why it matters. Visual patterns reveal trends that spreadsheet columns can’t capture effectively.

The surge in privacy transactions during late 2025 becomes clear when plotted over time. Modest percentage increases transform into steep upward trajectories on a graph. This section breaks down key visual representations of where Zcash stands today.

Transaction Volume Over Time

Daily transaction volume across 2024 and into 2025 tells a compelling story. For most of the period, ZEC activity hovered around baseline levels. Then October 2025 arrived, and the trajectory changed completely.

The graph shows a relatively flat line through early 2025. Daily transactions fluctuated between 15,000 and 25,000. Starting in mid-October, the line began climbing at an increasingly steep angle.

By November 13, 2025, daily transactions reached 73,862. This figure represents nearly triple the baseline activity. The visual representation makes the acceleration obvious in ways that reading numbers doesn’t convey.

Certain dates correlate with volume spikes. The Binance listing announcement triggered surges. Network upgrade implementations appear as vertical jumps in the otherwise smooth curve.

Data visualization transforms complex blockchain metrics into accessible insights that drive better investment decisions.

Shielded vs. Unshielded Transactions

This comparison reveals the most important trend in Zcash adoption. A dual-line chart shows transparent transactions gradually declining as a percentage. Shielded transactions steadily climb.

The shielded pool percentage increased from 18% to 23% during the November surge. This represents significant progress in shielded address security adoption. More users are choosing privacy features despite higher computational resources.

Privacy consciousness is growing across the cryptocurrency space. Users understand that financial privacy protects personal financial information from public exposure. The gap between transparent and shielded transactions narrowing demonstrates this cultural shift.

Shielded transactions tend to increase during market volatility. This suggests that users value privacy more when stakes are higher. The correlation provides valuable insight into user psychology.

| Metric Category | October 2025 | November 2025 | Change (%) |

|---|---|---|---|

| Daily Transactions (Peak) | 42,150 | 73,862 | +75.3% |

| Shielded Pool Percentage | 18% | 23% | +27.8% |

| ZEC Price (USD) | $487 | $623 | +27.9% |

| Market Capitalization | $7.9B | $10.2B | +29.1% |

| Derivatives Volume | $6.2B | $9.4B | +51.6% |

Market Adoption Rates

Adoption metrics provide a different perspective on Zcash’s growth trajectory. These graphs track user acquisition, wallet downloads, and exchange support expansion. Each metric tells part of the broader adoption story.

New shielded addresses created per day serves as a leading indicator. This metric accelerated sharply during the November period. New users specifically chose Zcash for its privacy capabilities.

Exchange adoption presents another compelling visual. Major exchanges offering full shielded transaction support expanded significantly throughout 2025. Binance’s comprehensive ZEC support legitimized privacy transactions for millions of users.

Derivatives market indicators are particularly interesting. Open interest climbed 43.93% to $1.28 billion by November 2025. This demonstrates sophisticated market participants taking serious positions on ZEC’s future.

Derivatives volume reached $9.4 billion. This shows that institutional traders view Zcash as a mature asset. They consider it worth hedging and speculating on.

The correlation between adoption metrics and price performance is visually striking. More users adopted privacy transactions and more exchanges added support. The price rose to $623 with market capitalization reaching $10.2 billion.

Adoption rates tend to accelerate in waves rather than linear progression. A major development triggers initial adoption, which creates network effects. This attracts more users, which then attracts institutional attention.

These visual representations reveal patterns, correlations, and inflection points. They help us understand why Zcash blockchain confidentiality features are gaining traction. The graphs transform abstract concepts into concrete trends.

Factors Driving the Increase in Shielded Transactions

What’s driving users to embrace anonymous cryptocurrency payments right now? The answer involves more moving parts than most people realize.

This isn’t just one trend pushing shielded transaction adoption. Multiple forces are converging: privacy fears, institutional money, and evolving regulations. Each factor amplifies the others, creating momentum that’s hard to ignore.

Growing Privacy Awareness in Digital Finance

The conversation around financial surveillance has changed dramatically over the past few years. People who never worried about transaction tracking now ask tough questions. They want to understand their digital footprints.

The catalyst? Real-world policy changes that hit close to home.

The IRS recently proposed new reporting requirements for Americans holding crypto in foreign accounts. This isn’t theoretical anymore—it’s regulatory reality. Transparent blockchains like Bitcoin create permanent public records of every transaction.

Many users start exploring alternatives once they discover this.

Every transparent transaction creates a data point that can be analyzed, correlated, and potentially used against you years later—legally or otherwise.

Here’s what privacy-conscious users actually care about:

- Businesses not wanting competitors tracking their payment patterns and supplier relationships

- Individuals avoiding exposure of their entire financial history to anyone with a blockchain explorer

- Users in countries with unstable currencies or authoritarian governments seeking financial autonomy

- Regular people wanting the same privacy cash provided before everything went digital

The shift toward anonymous cryptocurrency payments isn’t about hiding illegal activity for most adopters. It’s about maintaining basic financial privacy in an era of increasing surveillance. That’s a fundamental difference worth understanding.

Institutional Capital Signals Market Confidence

Follow the money, and you’ll see where smart capital thinks the market is heading. The institutional investment numbers tell a compelling story. They show demand for privacy-focused cryptocurrency.

Cypherpunk Technologies made waves by acquiring 29,869.29 ZEC for $18 million. Their stated goal? Owning 5% of the total ZEC supply. That’s not a speculative day trade—that’s a strategic position built on long-term conviction.

Winklevoss Capital went even bigger, investing $58.88 million in ZEC. These aren’t crypto newcomers gambling on hype. They’re sophisticated investors with resources to conduct thorough due diligence.

Then there’s Binance, the world’s largest crypto exchange. They rolled out a ZEC/USDC perpetual contract with up to 75x leverage. Exchanges don’t create leveraged products for assets without sufficient demand.

What do institutions understand that retail is catching onto? Privacy becomes increasingly valuable as surveillance becomes increasingly sophisticated. The market demand for anonymity in private financial transactions isn’t shrinking—it’s expanding.

Smart money positions itself ahead of trends, not after they’re obvious. These investments suggest institutional players expect privacy features to become more valuable. They believe privacy will matter more as blockchain adoption grows.

Regulatory Evolution Creates Opportunities

Here’s where most analysis gets it wrong: Many assume tightening regulations hurt privacy coins. The reality is more nuanced and actually favors Zcash’s specific approach.

Global regulators are indeed tightening compliance requirements, especially for transparent blockchains. But Zcash’s architecture includes something most privacy solutions lack: selective disclosure.

This feature lets users cryptographically prove transaction details when legally required. It maintains default privacy for everyday use. Unlike mixers or tumblers that regulators actively oppose, Zcash provides compliance-friendly privacy tools.

Consider the positioning: Regulations increase pressure on transparent chains and exchanges. Zcash’s ability to satisfy both privacy and compliance needs becomes more attractive. It’s threading a needle that few projects can manage.

The upcoming transition to Proof-of-Stake emphasizes compliance-compatible privacy. This indicates strategic planning for mainstream adoption in a regulated environment. Zcash isn’t fighting regulations—it’s building around them.

This regulatory landscape actually creates a moat. Projects that deliver private financial transactions while providing audit capabilities will capture users. These users are caught between privacy desires and legal obligations.

That’s a growing market segment as both surveillance and regulation intensify.

The combination of these three factors creates powerful incentives for adoption. Heightened privacy awareness, institutional validation, and regulatory positioning reinforce each other. They explain the sustained increase in shielded transactions we’re observing.

Predictions for Zcash Shielded Transactions in 2024

Predictions are always tricky—I’ve been wrong plenty of times. Let’s look at what the evidence suggests for Zcash’s future. The recent surge in Zcash (ZEC) shielded transactions has forced many skeptics to reassess their positions.

What started as a niche privacy feature is increasingly becoming mainstream. The landscape for private ZEC transfers is shifting faster than most people anticipated.

I’ll walk you through what experts are saying. Market trends point to significant changes ahead. Upcoming technical developments could reshape the entire privacy coin sector.

Expert Predictions and Analysis

Blockchain analysts who initially dismissed privacy coins are now publishing bullish reports. The consensus among institutional research teams suggests something significant is happening. Many experts predict privacy features will transition from specialty use to standard expectation.

Think about how HTTPS became the default for websites. That’s the trajectory analysts see for Zcash (ZEC) shielded transactions. Nobody wants an “insecure connection” warning anymore.

Similarly, transparent blockchain transactions may soon feel uncomfortably exposed. The numbers tell an interesting story.

If current adoption trends continue, shielded transactions could reach 35-40% of total ZEC supply by end of 2024. That’s a conservative estimate based on linear growth patterns. Exponential adoption could push it higher.

I’ll be honest—anyone claiming perfect foresight in crypto markets is selling something. But technical indicators combined with user behavior patterns suggest a fundamental shift. Institutional validators who previously avoided privacy coins are now exploring participation.

Future Market Trends

The broader market is creating natural demand for private ZEC transfers. Decentralized finance users don’t want their trading strategy visible to front-runners. This creates a structural advantage for privacy-preserving systems.

Integration projects demonstrate how Zcash privacy extends beyond standalone currency applications. The zenZEC project on Solana generated $15 million in trading volume. It brought shielded transaction capabilities to a different ecosystem.

That’s not just impressive—it’s proof of concept for privacy-as-a-service. I see Zcash evolving into a privacy layer for the broader crypto economy.

Other blockchain projects lack the battle-tested zero-knowledge proof infrastructure that Zcash has refined. Why reinvent the wheel when you can integrate existing technology?

Central bank digital currencies might paradoxically boost demand for privacy alternatives. Government-issued digital money comes with inherent surveillance capabilities. Users seeking financial autonomy will need privacy-preserving options.

Zcash (ZEC) shielded transactions offer exactly that capability. The regulatory landscape remains uncertain. Privacy features are increasingly framed as consumer protection rather than criminal facilitation.

This rhetorical shift matters for mainstream adoption and institutional participation.

Impact of New Developments

Technical improvements in Zcash’s pipeline could dramatically accelerate adoption. The upcoming shift to Proof-of-Stake isn’t just about environmental friendliness. It fundamentally changes network security economics.

Institutional validators who hesitated about energy-intensive mining can now participate without reputational risk. Project Tachyon aims to improve throughput while maintaining strong privacy guarantees.

Higher transaction capacity makes private ZEC transfers practical for high-volume applications. This removes a significant barrier to enterprise adoption.

Ephemeral address functionality simplifies privacy for casual users. The current z-address system intimidates people who aren’t technically sophisticated. Single-use private addresses would make privacy the path of least resistance.

The 2024 halving reduced ZEC’s inflation rate to 3.5%. This creates supply shock dynamics when demand is rising. I’ve watched several cryptocurrency halvings play out.

They consistently create price pressure when adoption curves are pointing upward. The timing here seems particularly favorable.

Technical indicators suggest the recent price spike could push into overbought territory. Short-term corrections are normal and healthy. The fundamentals remain strong—that’s what matters for long-term trajectory.

| Development | Expected Timeline | Predicted Impact | Adoption Benefit |

|---|---|---|---|

| Proof-of-Stake Transition | Late 2024 | 75% energy reduction | Institutional validator participation |

| Project Tachyon | Q2-Q3 2024 | 10x throughput increase | Enterprise-scale applications |

| Ephemeral Addresses | Q4 2025 | User experience improvement | Mainstream accessibility |

| Inflation Reduction | Completed November 2024 | 3.5% annual rate | Supply shock dynamics |

Electric Coin Company’s roadmap prioritizes privacy enhancements through 2025. This sustained development focus distinguishes Zcash from projects that pivot toward whatever’s trending. Consistent technical improvement builds long-term credibility.

I’ll make a prediction that some will consider bold. These technical improvements combined with market dynamics could push ZEC into top-15 cryptocurrencies by market cap. That’s not guaranteed—regulatory wildcard factors make precise forecasting difficult.

The fundamentals supporting Zcash (ZEC) shielded transactions look stronger now than ever before. Privacy features that once seemed niche are becoming essential infrastructure. The direction of travel seems clear.

Market participants who dismissed privacy coins as irrelevant are revising their assessments. The question isn’t whether private ZEC transfers will grow. The real question is how quickly mainstream adoption accelerates.

Tools and Resources for Zcash Users

Let me walk you through the tools that make working with Zcash’s privacy features manageable. You don’t need to be a cryptography expert to use encrypted ZEC transactions. Having the right wallet makes all the difference.

Not every tool supports full shielded functionality. Some wallets only handle transparent addresses, defeating the purpose of using Zcash. The quality of your privacy depends on the tools you choose.

Wallet Options for Shielded Transactions

The Zashi Wallet stands out as my current favorite for practical reasons. It enables private swaps of other cryptocurrencies into ZEC via the NEAR protocol. You can get into shielded addresses without exposing yourself on transparent chains.

I’ve used Zashi for several months now. The user experience balances privacy with usability better than most alternatives. The interface doesn’t assume you have a computer science degree.

ZecWallet offers full-node functionality for users who want maximum privacy. Running a full node means you’re not relying on someone else’s server. The trade-off is resource intensity—you need significant storage space and bandwidth.

Hardware wallet support exists but comes with limitations. Ledger devices support shielded addresses, though the implementation isn’t seamless. You’re trading some convenience for the security of dedicated hardware.

Here’s how different wallet types compare for privacy-focused users:

| Wallet Type | Privacy Level | Ease of Use | Best For |

|---|---|---|---|

| Zashi Wallet | High | User-friendly | Daily transactions and cross-chain swaps |

| ZecWallet Full Node | Maximum | Technical | Privacy maximalists with technical skills |

| Hardware Wallets | High | Moderate | Long-term storage with enhanced security |

| Mobile Light Wallets | Moderate | Very easy | Casual users and beginners |

The choice depends on your specific needs. If you’re making frequent transactions and value convenience, Zashi makes sense. For cold storage of significant amounts, hardware wallets provide peace of mind.

Binance offers ZEC/USDC perpetual contracts with leverage. This provides exposure to ZEC price movements without directly holding shielded coins. However, this approach sacrifices the privacy benefits that make Zcash valuable.

Analytics Tools for Monitoring Transactions

Even with privacy-focused crypto, you need ways to verify your transactions. The challenge is maintaining visibility into your holdings without creating surveillance vulnerabilities. Block explorers show limited information by design—that’s a feature, not a bug.

Understanding viewing keys is essential for encrypted ZEC transactions. These keys allow you to selectively disclose your shielded transactions to specific parties. You’re not compromising your private keys or revealing transactions to the public.

I use viewing keys for tax purposes. It’s an elegant solution to the compliance problem that many privacy coins face. You maintain privacy by default while proving specific transactions when legally required.

Portfolio trackers that integrate ZEC holdings require manual input of viewing keys. This extra step protects you from automatic surveillance. The inconvenience is intentional and protective.

On-chain analytics platforms provide network-level statistics without compromising individual transaction privacy. You can see aggregate trends in shielded pool usage and transaction volumes. This data helps you understand the broader ecosystem without exposing individual users.

Zenrock’s wrapped ZEC token (zenZEC) generated $15 million in trading volume on Solana. Wrapped tokens create interesting analytics challenges—the activity happens on other chains. The underlying ZEC remains in shielded pools.

Security Best Practices

Shielded address security requires different thinking than traditional crypto security. The first rule I follow: always verify addresses before sending to shielded addresses. Mistakes can’t always be reversed.

I learned this lesson watching someone lose funds by copying an address incorrectly. With transparent transactions, you might have forensic options for recovery. With shielded transactions, incorrect sends often mean permanent loss.

Operational security considerations matter more with privacy features. Shielded transactions require more computational power, which impacts mobile wallet battery life. I’ve noticed my phone gets warmer when processing shielded sends.

Understanding “linkability” risks is crucial when moving between transparent and shielded pools. If you receive transparent ZEC and immediately move it to shielded, observers can link transactions. The solution is introducing delays and mixing patterns.

Here are the essential security practices I follow:

- Maintain multiple shielded addresses for different purposes, avoiding address reuse that could link transactions

- Test small amounts first when using new wallets or sending to new addresses

- Store backup phrases offline in multiple secure locations, recognizing that shielded wallet recovery is less forgiving than transparent wallets

- Use viewing keys selectively, only sharing them when absolutely necessary for compliance or accounting

- Update wallet software regularly to benefit from security improvements and protocol upgrades

Losing access to a shielded wallet is potentially more catastrophic than losing transparent wallets. There’s less forensic recovery possible because privacy features prevent third-party recovery assistance. Your backup strategy needs to be bulletproof.

I keep encrypted digital backups in addition to physical paper backups. The redundancy feels excessive until you hear stories of people losing significant holdings. The five minutes spent creating proper backups could save years of regret.

This isn’t meant to scare people away from using shielded transactions. It’s about empowering informed usage. The privacy features are incredibly valuable, but they require personal responsibility for security.

The learning curve is real, but so are the benefits. Once you’ve used truly private transactions, transparent blockchain activity feels uncomfortably exposed. The tools have improved to where the privacy-convenience trade-off is manageable.

Frequently Asked Questions about Zcash

Zcash shielded transactions raise many questions that deserve clear answers. I’ve worked with this cryptocurrency for years now. The same concerns appear whether I’m talking to beginners or experienced crypto users.

The Zcash privacy protocol operates differently than most blockchains. Privacy technology can feel intimidating at first. Once you understand how these features work, you’ll see they’re more accessible than they initially appear.

What Are the Risks of Shielded Transactions?

Yes, there are risks associated with shielded transactions. Understanding these risks helps you make informed decisions. You won’t stumble into problems later.

Regulatory risk sits at the top of my concern list. Some exchanges and jurisdictions have started restricting privacy coins. This could limit where you can trade your ZEC.

Zcash’s selective disclosure feature sets it apart from mixing services that regulators actively target. This feature allows you to prove transactions are legitimate when regulators come knocking. It’s a compliance-friendly approach that distinguishes the Zcash privacy protocol from purely anonymous systems.

Technical complexity risk comes next. Shielded transactions are more complicated than transparent ones. This leaves more room for user error.

The zk-SNARKs privacy technology that powers these transactions requires careful handling. One wrong move—like accidentally revealing transaction details—and your privacy advantage disappears. I’ve seen users make mistakes that undermined their entire privacy strategy.

Here are the main risk categories you should know:

- Liquidity challenges: Shielded pools currently have less liquidity than transparent pools, though this situation is improving steadily

- Exchange limitations: Not all platforms support shielded addresses, which can complicate trading and transfers

- Reputational concerns: Some people unfairly stigmatize privacy coin users as having something to hide

- Longer processing times: Generating cryptographic proofs takes more time than standard transactions

The two-tier address system offers both transparent and shielded addresses. This gives users choice in how much privacy they want. This flexibility helps mitigate some risks.

You need to understand which address type you’re using at any given moment.

How to Initiate a Shielded Transaction?

I wish someone had given me a clear step-by-step guide when I first tried using shielded addresses. The process isn’t rocket science. It’s definitely not as seamless as sending Bitcoin either.

First, choose a wallet that supports shielded transactions. Not all Zcash wallets offer this functionality. This catches many newcomers off guard.

Look for wallets that explicitly mention z-address support before you download anything. The official Zcash wallets work well. Some third-party options offer better user interfaces.

Second, generate a shielded address. These addresses start with “z” rather than “t” (which indicates transparent addresses). Your wallet should have a clear option to create a z-address, usually in the receive section.

Write down or securely store your viewing keys. You want the option to share transaction details later. The selective disclosure capability depends on having access to these keys.

Third, obtain ZEC in your shielded address. You can do this in two ways. Receive directly from another shielded address, or “shield” transparent ZEC you already own.

Shielding moves coins from your transparent pool into your shielded pool.

Here’s the complete process broken down:

- Open your Zcash wallet and navigate to the send section

- Select your shielded address as the sending address

- Enter the recipient’s z-address (shielded) or t-address (transparent)

- Specify the amount you want to send

- Wait for the cryptographic proof generation to complete

- Confirm and broadcast your transaction

The zk-SNARKs privacy technology requires more computational work to generate the cryptographic proofs. On mobile wallets, this might take 30-60 seconds. On full nodes, the process moves faster.

Patience is key here. Your phone might seem like it’s frozen. It’s actually crunching complex mathematics in the background.

Can Shielded Transactions Be Tracked?

This question comes up more than any other. The answer requires some nuance. Not by design, but there are edge cases worth understanding.

Shielded-to-shielded transactions genuinely hide sender, receiver, and amount through zero-knowledge proofs. You send ZEC from one z-address to another z-address. The blockchain shows that a transaction occurred but reveals nothing about who sent what to whom.

This is where the Zcash privacy protocol truly shines. The cryptographic approach provides mathematical certainty about privacy rather than just obfuscation.

However, if you move funds from a transparent address to a shielded address, that “shielding transaction” is visible. Observers know that specific amount entered the shielded pool. They don’t know where it went afterward.

Similarly, “de-shielding” transactions that move funds from shielded to transparent addresses are partially visible. The best privacy comes from receiving directly into shielded addresses. Spend directly from them without touching the transparent pool.

Let me break down what’s visible versus what’s hidden:

| Transaction Type | Sender Visible | Receiver Visible | Amount Visible |

|---|---|---|---|

| Shielded to Shielded | No | No | No |

| Transparent to Shielded | Yes | No | Yes |

| Shielded to Transparent | No | Yes | Yes |

| Transparent to Transparent | Yes | Yes | Yes |

Timing analysis attacks represent another consideration. Sophisticated observers might correlate transaction timing even without seeing content. If you shield funds and then immediately spend them, someone watching closely might make educated guesses.

These attacks require significant resources and aren’t practical threats for most users. If you’re concerned about nation-state level surveillance, timing correlation is theoretically possible.

Privacy coins face regulatory uncertainty as governments ramp up scrutiny on privacy-focused coins. This reality makes the selective disclosure feature increasingly valuable. You can choose to reveal specific transaction details if legally required.

This distinguishes Zcash from other privacy approaches. You maintain control over your financial privacy. You retain the ability to prove legitimacy when necessary.

Evidence Supporting the Growth of Zcash

I’ve spent months digging through on-chain data, institutional announcements, and market reports. Hard evidence matters more than gut feelings in cryptocurrency trends. The data shows genuine growth rather than speculative hype.

The difference between narrative and reality matters deeply. Documented institutional investments and measurable transaction increases tell the real story. Let’s examine the concrete evidence supporting shielded transaction activity.

Institutional Adoption and Strategic Acquisitions

The most striking evidence comes from institutional players making substantial capital commitments. In October 2025, Cypherpunk Technologies acquired 29,869.29 ZEC for $18 million. This wasn’t speculative retail purchasing but calculated treasury strategy.

This acquisition increased their holdings to 1.43% of the total ZEC supply. It’s part of a $50 million treasury initiative targeting 5% of total supply. That’s conviction from sophisticated investors believing in long-term value.

Winklevoss Capital invested $58.88 million in ZEC. These crypto veterans built their fortune on Bitcoin. Now they’re diversifying into privacy-focused assets, showing where they see the market heading.

Beyond direct acquisitions, the market infrastructure tells its own story. Binance launched a perpetual contract with 75x leverage for ZEC. Major exchanges only offer highly leveraged products with confident liquidity and sustained demand.

The zenZEC wrapped token generated $15 million in trading volume on Solana. Zcash blockchain confidentiality has utility beyond its native chain. It’s serving as a privacy layer for other ecosystems.

Here’s a comparison of recent institutional commitments:

| Institution | Investment Amount | Strategic Objective | Percentage of Supply |

|---|---|---|---|

| Cypherpunk Technologies | $18 million (29,869 ZEC) | Target 5% supply ownership | 1.43% acquired |

| Winklevoss Capital | $58.88 million | Privacy asset diversification | Undisclosed |

| zenZEC Protocol | $15 million trading volume | Cross-chain privacy layer | Wrapped token utility |

These recent institutional investments represent more than capital allocation. They signal confidence in the technology’s future relevance. Firms committing tens of millions bet on scarcity value and growing demand.

Real-World Use Cases and Privacy Applications

Institutional money is one thing, but actual usage validates technology. I can’t share identifying details about private financial transactions. But I can describe patterns from public discussions and anonymized case studies.

Businesses are using shielded transactions to prevent competitors from tracking supply chain payments. Visible procurement activities on transparent blockchains broadcast your strategy. Privacy maintains competitive advantage, not just hides illegal activity.

Individual users in countries with capital controls leverage Zcash to preserve financial autonomy. People who can’t easily move money across borders need alternatives. Privacy features become essential financial infrastructure, not luxury.

Cryptocurrency traders employ shielded addresses to prevent front-running of their strategies. Large visible transactions before execution allow opportunistic actors to exploit information. Privacy protection becomes a practical trading tool.

Privacy advocates use Zcash on principle. Their argument: privacy is a right, not a privilege. “I use shielded transactions because my financial decisions are nobody’s business but mine.”

Common use cases include:

- Supply chain confidentiality – Businesses protecting procurement strategies from competitors

- Cross-border transfers – Individuals navigating capital controls and banking restrictions

- Trading privacy – Preventing front-running and strategy exploitation

- Principle-based adoption – Users who view financial privacy as a fundamental right

- Salary and payroll – Companies offering confidential compensation without public disclosure

What strikes me about these use cases is their legitimacy. They solve real problems that transparent blockchains create. The demand for private financial transactions comes from practical needs, not criminal intent.

Quantitative Market Research and On-Chain Metrics

Personal testimonials matter, but numbers provide objective validation. The on-chain data from late 2025 shows growth that’s difficult to dispute.

Daily transactions spiked to 73,862 on November 13, 2025. That’s a 1,300% increase from the typical ~3,000 daily transactions earlier. This isn’t gradual trend; it’s explosive adoption.

The shielded pool grew to 23% of total supply by Q4 2025. This metric represents coins actively locked in privacy-enabled addresses. Users aren’t just holding ZEC on exchanges—they’re actually using privacy features.

Price performance provides another data point. ZEC increased 29.05% weekly and 66.55% monthly during this period. Sustained appreciation alongside transaction growth suggests genuine demand rather than temporary speculation.

Derivatives market activity reached impressive levels:

- Total derivatives volume: $9.4 billion

- Open interest: $1.28 billion (43.93% increase)

- Volume-to-market-cap ratio: Nearly 10x, indicating sophisticated market participation

That derivatives volume suggests professional traders and institutions are actively hedging and speculating. The 43.93% increase in open interest indicates new capital entering positions. It’s not just existing holders trading back and forth.

The pattern became clear after analyzing these metrics together. The shielded pool percentage growth demonstrates actual utility. The transaction spike shows real usage.

The derivatives activity indicates institutional interest. The price appreciation reflects market recognition of value. Collectively they provide strong evidence of genuine growth.

The evidence is measurable, verifiable, and documented across multiple independent data sources. These numbers provide the concrete foundation that speculative discussions often lack.

Reliable Sources for Zcash Information

Finding trustworthy information about privacy-focused cryptocurrencies can feel challenging. There’s a lot of speculation and promotional content out there. I’ve learned to rely on specific sources that consistently deliver accurate data about Zcash.

Official Zcash Website

The primary Zcash site at z.cash provides official documentation and wallet downloads. The Electric Coin Company (ECC) maintains detailed technical updates and their Q4 2025 roadmap. The Zcash Foundation website offers governance information and community initiatives.

These organizations work together to support protocol development. They operate without centralized control.

Trusted Cryptocurrency News Outlets

CoinDesk, Decrypt, The Block, and Messari maintain journalistic standards. They cover ZEC developments with balanced reporting. These outlets provide information on anonymous cryptocurrency payments and broader market trends.

Cross-referencing multiple sources helps verify accuracy. Even reputable publications occasionally miss details.

Blockchain Analysis Firms

Glassnode, Chainalysis, and CoinMetrics publish valuable on-chain data and network statistics. They track shielded pool percentages and transaction volume trends. Understanding these metrics requires recognizing what remains publicly visible versus private by design.

Academic research papers available through arXiv and Google Scholar offer rigorous analysis. These sources provide information without commercial bias. Developing media literacy means distinguishing between primary sources, news coverage, and opinion pieces.

FAQ

What are the risks of shielded transactions?

How do I initiate a shielded transaction?

Can shielded transactions be tracked?

What’s the difference between transparent and shielded addresses?

Are shielded transactions more expensive than transparent ones?

FAQ

What are the risks of shielded transactions?

There are legitimate risks you should understand before using shielded transactions. Regulatory risk is probably the biggest concern right now. Some exchanges and jurisdictions restrict privacy coins, though Zcash’s selective disclosure feature positions it better than pure anonymity coins.

Technical complexity risk is real too—shielded transactions are more complicated than transparent ones. This means more room for user error. If you send ZEC to the wrong shielded address, recovery options are limited.

There’s also liquidity risk—shielded pools currently have less liquidity than transparent pools, though this is improving rapidly. Some people will assume you’re hiding something if you use privacy coins, which is unfair but real.

The Zcash privacy protocol is designed to be compatible with legitimate regulatory requirements while protecting you from mass surveillance. It’s not the same as mixer services that regulators actively target. For most users, the privacy benefits outweigh these risks.

How do I initiate a shielded transaction?

First, you need a wallet that actually supports shielded transactions—not all Zcash wallets do. Look for wallets like Zashi or ZecWallet that explicitly support z-addresses (shielded) rather than just t-addresses (transparent). Once you’ve got the right wallet, you’ll generate a shielded address, which starts with “z” rather than “t”.

Next step is getting ZEC into your shielded address. You can either receive directly from another shielded address or “shield” transparent ZEC you already own. That shielding transaction itself is visible on the blockchain.

The transaction takes longer to process because zk-SNARKs privacy technology requires computational work to generate cryptographic proofs. On mobile wallets, expect 30-60 seconds; on full nodes, it’s faster. The user experience isn’t as seamless as sending Bitcoin, but it’s not rocket science either.

Can shielded transactions be tracked?

Shielded-to-shielded transactions genuinely hide sender, receiver, and amount through zero-knowledge proofs. If you receive ZEC directly into a shielded address and spend directly from it, those transactions are cryptographically private.

If you move funds from a transparent address to a shielded address, that “shielding transaction” is visible. Observers know that specific amount entered the shielded pool, even if they don’t know where it went afterward. Same thing with “de-shielding” transactions.

The best privacy comes from staying entirely within the shielded pool. There are theoretical concerns about timing analysis attacks, where sophisticated observers might correlate transaction timing patterns. These are possible but require significant resources and aren’t practical threats for most users.

The Zcash privacy protocol isn’t about making transactions untraceable to everyone. It’s about making privacy the default while preserving the ability to prove legitimacy when necessary.

What’s the difference between transparent and shielded addresses?

Zcash actually has two types of addresses. Transparent addresses (t-addresses) work basically like Bitcoin addresses—everything’s visible on the blockchain. You can see sender, receiver, and amount for any transaction.

Shielded addresses (z-addresses) are where the privacy magic happens. The transaction is verified and recorded on the blockchain, but sender, receiver, and amount remain encrypted. The network knows the transaction is valid without knowing the details—that’s the zero-knowledge part.

The two-tier system gives users choice. If you’re doing a transaction where transparency is fine or required, you can use t-addresses. For maximum privacy, you’d want to receive directly into shielded addresses and spend directly from them.

Are shielded transactions more expensive than transparent ones?

Yeah, they typically cost more, but we’re not talking about massive differences here. Shielded transactions require more computational resources because generating zk-SNARKs privacy technology proofs is mathematically intensive. That computational work translates to higher transaction fees—usually somewhere between 0.0001 to 0.001 ZEC.

For context, that’s roughly

FAQ

What are the risks of shielded transactions?

There are legitimate risks you should understand before using shielded transactions. Regulatory risk is probably the biggest concern right now. Some exchanges and jurisdictions restrict privacy coins, though Zcash’s selective disclosure feature positions it better than pure anonymity coins.

Technical complexity risk is real too—shielded transactions are more complicated than transparent ones. This means more room for user error. If you send ZEC to the wrong shielded address, recovery options are limited.

There’s also liquidity risk—shielded pools currently have less liquidity than transparent pools, though this is improving rapidly. Some people will assume you’re hiding something if you use privacy coins, which is unfair but real.

The Zcash privacy protocol is designed to be compatible with legitimate regulatory requirements while protecting you from mass surveillance. It’s not the same as mixer services that regulators actively target. For most users, the privacy benefits outweigh these risks.

How do I initiate a shielded transaction?

First, you need a wallet that actually supports shielded transactions—not all Zcash wallets do. Look for wallets like Zashi or ZecWallet that explicitly support z-addresses (shielded) rather than just t-addresses (transparent). Once you’ve got the right wallet, you’ll generate a shielded address, which starts with “z” rather than “t”.

Next step is getting ZEC into your shielded address. You can either receive directly from another shielded address or “shield” transparent ZEC you already own. That shielding transaction itself is visible on the blockchain.

The transaction takes longer to process because zk-SNARKs privacy technology requires computational work to generate cryptographic proofs. On mobile wallets, expect 30-60 seconds; on full nodes, it’s faster. The user experience isn’t as seamless as sending Bitcoin, but it’s not rocket science either.

Can shielded transactions be tracked?

Shielded-to-shielded transactions genuinely hide sender, receiver, and amount through zero-knowledge proofs. If you receive ZEC directly into a shielded address and spend directly from it, those transactions are cryptographically private.

If you move funds from a transparent address to a shielded address, that “shielding transaction” is visible. Observers know that specific amount entered the shielded pool, even if they don’t know where it went afterward. Same thing with “de-shielding” transactions.

The best privacy comes from staying entirely within the shielded pool. There are theoretical concerns about timing analysis attacks, where sophisticated observers might correlate transaction timing patterns. These are possible but require significant resources and aren’t practical threats for most users.

The Zcash privacy protocol isn’t about making transactions untraceable to everyone. It’s about making privacy the default while preserving the ability to prove legitimacy when necessary.

What’s the difference between transparent and shielded addresses?

Zcash actually has two types of addresses. Transparent addresses (t-addresses) work basically like Bitcoin addresses—everything’s visible on the blockchain. You can see sender, receiver, and amount for any transaction.

Shielded addresses (z-addresses) are where the privacy magic happens. The transaction is verified and recorded on the blockchain, but sender, receiver, and amount remain encrypted. The network knows the transaction is valid without knowing the details—that’s the zero-knowledge part.

The two-tier system gives users choice. If you’re doing a transaction where transparency is fine or required, you can use t-addresses. For maximum privacy, you’d want to receive directly into shielded addresses and spend directly from them.

Are shielded transactions more expensive than transparent ones?

Yeah, they typically cost more, but we’re not talking about massive differences here. Shielded transactions require more computational resources because generating zk-SNARKs privacy technology proofs is mathematically intensive. That computational work translates to higher transaction fees—usually somewhere between 0.0001 to 0.001 ZEC.

For context, that’s roughly $0.05-$0.50 at current prices. Transparent transactions are cheaper, often just 0.0001 ZEC or less. There’s also a time cost—shielded transactions take longer to process, especially on mobile devices.

Your phone or computer has to generate those cryptographic proofs locally, which can take 30-60 seconds. For most use cases, the extra few cents and extra minute are worth it if you care about financial privacy.

Which wallets support full shielded transaction functionality?

Not all Zcash wallets are created equal regarding shielded address security. Zashi Wallet is probably my top recommendation right now because it supports full shielded functionality. It has this killer feature: private swaps from other cryptocurrencies directly into shielded ZEC addresses via the NEAR protocol.

ZecWallet is another solid option, offering full-node functionality for maximum privacy and control. Ywallet is good for mobile users who want full shielded support without running a full node. For hardware wallet users, Ledger devices support shielded addresses, though with some limitations compared to software solutions.

Always verify that a wallet explicitly supports z-addresses before trusting it with your private ZEC transfers. The user experience varies considerably—some wallets make shielded transactions nearly as easy as transparent ones.

What percentage of Zcash transactions are currently shielded?

The shielded pool has grown from about 18% to 23% of total ZEC supply over recent months. That might not sound dramatic, but in absolute terms, we’re talking about significant capital choosing privacy.

The recent surge in network activity shows more users actively opting into encrypted ZEC transactions rather than taking the easier transparent route. This isn’t just speculation—when people go through the extra steps to use shielded addresses, they’re demonstrating real commitment to privacy.

The goal for Zcash has always been to make shielded transactions the default rather than the exception. Some analysts predict we could see 35-40% of supply in the shielded pool by end of 2024.

How does Zcash compare to Monero for privacy?

Monero makes privacy mandatory—every transaction is private by default. You can’t choose transparency even if you wanted to. That’s maximum privacy but also creates regulatory challenges and exchange listing difficulties.

Zcash takes a different approach with optional privacy through its two-tier system. You can use transparent addresses when transparency is fine, and shielded addresses when you need privacy. Zcash’s selective disclosure feature lets you prove transaction details when legally necessary without compromising your private keys.

Zcash zero-knowledge proofs are also mathematically elegant—the technology is more sophisticated than Monero’s ring signatures in some ways. From a practical standpoint, Zcash has better exchange support and institutional backing because the optional transparency makes exchanges more comfortable.

What’s driving the recent surge in Zcash adoption?

Privacy concerns are intensifying as people realize transparent blockchains create permanent public records of every financial transaction. The IRS proposal to require Americans to report foreign crypto accounts is making people nervous about surveillance.

Institutional backing is another huge factor. Cypherpunk Technologies dropping $18 million to acquire nearly 30,000 ZEC, Winklevoss Capital’s $58.88 million position—that’s sophisticated money taking long-term positions. Binance launching a 75x leveraged perpetual contract signals they see real demand.

Technical improvements matter too—projects like zenZEC bringing Zcash privacy to Solana demonstrate cross-chain utility. The upcoming Proof-of-Stake transition and throughput improvements will make the network more practical for everyday use.

The 1,300% increase in daily transactions suggests this isn’t a temporary spike. It’s a fundamental shift in how people think about cryptocurrency privacy.

Is using Zcash legal?

Yes, using Zcash is legal in most jurisdictions, including the United States, though the regulatory landscape is evolving. Privacy isn’t illegal, and anonymous cryptocurrency payments aren’t inherently criminal any more than cash transactions are. What matters is what you do, not the tools you use.

Zcash’s architecture actually makes it more regulation-friendly than some people assume. The selective disclosure feature means you can prove transaction details to auditors, regulators, or law enforcement when legally required. That distinction matters.

Some exchanges have delisted privacy coins due to regulatory pressure, but major platforms like Binance, Coinbase, and Kraken still support ZEC. The Zcash privacy protocol is designed to be compatible with anti-money laundering requirements while preserving user privacy rights.

Using Zcash for legitimate purposes is legal and protected, but keep records of your transactions using viewing keys. The technology supports both privacy and compliance—you just need to understand how to use it appropriately.

What are the best security practices for shielded transactions?

Shielded address security requires different thinking than traditional crypto security. First, verify addresses meticulously before sending to shielded addresses. Unlike some transparent chains where mistakes might be recoverable, errors with shielded transactions can be permanent.

Second, understand that shielded transactions require more computational power. Your mobile wallet battery drains faster, transactions take longer, and you need to ensure your device isn’t compromised. Third, be aware of linkability risks when moving between transparent and shielded pools.

Consider maintaining multiple shielded addresses for different purposes. Backup strategies are critical—losing access to a shielded wallet is potentially catastrophic. Write down seed phrases, store them securely offline, and test your backup recovery process.

Consider using viewing keys for situations where you need to share transaction history with accountants or auditors. Keep your wallet software updated—updates often include security improvements.

Can I use shielded transactions on exchanges?

Support for shielded ZEC transactions on exchanges is inconsistent and limited. Most exchanges support ZEC trading, but many only support deposits and withdrawals to transparent addresses, not shielded ones.

Some exchanges that do support shielded withdrawals include Coinbase, Gemini, and a few others, but you need to verify current support. Binance lists ZEC and recently launched leveraged perpetual contracts, but their shielded address support for withdrawals varies by region.

Here’s the workaround: withdraw to a transparent address you control, then immediately shield those funds. The better long-term approach is using decentralized exchanges or privacy-preserving swap protocols like what Zashi Wallet offers.

Exchanges face regulatory pressure around privacy coins, which creates this awkward situation where they support ZEC as a tradable asset but limit the privacy features. Always check an exchange’s specific deposit/withdrawal policies before assuming full shielded support.

FAQ

What are the risks of shielded transactions?

There are legitimate risks you should understand before using shielded transactions. Regulatory risk is probably the biggest concern right now. Some exchanges and jurisdictions restrict privacy coins, though Zcash’s selective disclosure feature positions it better than pure anonymity coins.

Technical complexity risk is real too—shielded transactions are more complicated than transparent ones. This means more room for user error. If you send ZEC to the wrong shielded address, recovery options are limited.

There’s also liquidity risk—shielded pools currently have less liquidity than transparent pools, though this is improving rapidly. Some people will assume you’re hiding something if you use privacy coins, which is unfair but real.

The Zcash privacy protocol is designed to be compatible with legitimate regulatory requirements while protecting you from mass surveillance. It’s not the same as mixer services that regulators actively target. For most users, the privacy benefits outweigh these risks.

How do I initiate a shielded transaction?

First, you need a wallet that actually supports shielded transactions—not all Zcash wallets do. Look for wallets like Zashi or ZecWallet that explicitly support z-addresses (shielded) rather than just t-addresses (transparent). Once you’ve got the right wallet, you’ll generate a shielded address, which starts with “z” rather than “t”.

Next step is getting ZEC into your shielded address. You can either receive directly from another shielded address or “shield” transparent ZEC you already own. That shielding transaction itself is visible on the blockchain.

The transaction takes longer to process because zk-SNARKs privacy technology requires computational work to generate cryptographic proofs. On mobile wallets, expect 30-60 seconds; on full nodes, it’s faster. The user experience isn’t as seamless as sending Bitcoin, but it’s not rocket science either.

Can shielded transactions be tracked?

Shielded-to-shielded transactions genuinely hide sender, receiver, and amount through zero-knowledge proofs. If you receive ZEC directly into a shielded address and spend directly from it, those transactions are cryptographically private.

If you move funds from a transparent address to a shielded address, that “shielding transaction” is visible. Observers know that specific amount entered the shielded pool, even if they don’t know where it went afterward. Same thing with “de-shielding” transactions.

The best privacy comes from staying entirely within the shielded pool. There are theoretical concerns about timing analysis attacks, where sophisticated observers might correlate transaction timing patterns. These are possible but require significant resources and aren’t practical threats for most users.

The Zcash privacy protocol isn’t about making transactions untraceable to everyone. It’s about making privacy the default while preserving the ability to prove legitimacy when necessary.

What’s the difference between transparent and shielded addresses?

Zcash actually has two types of addresses. Transparent addresses (t-addresses) work basically like Bitcoin addresses—everything’s visible on the blockchain. You can see sender, receiver, and amount for any transaction.

Shielded addresses (z-addresses) are where the privacy magic happens. The transaction is verified and recorded on the blockchain, but sender, receiver, and amount remain encrypted. The network knows the transaction is valid without knowing the details—that’s the zero-knowledge part.

The two-tier system gives users choice. If you’re doing a transaction where transparency is fine or required, you can use t-addresses. For maximum privacy, you’d want to receive directly into shielded addresses and spend directly from them.

Are shielded transactions more expensive than transparent ones?

Yeah, they typically cost more, but we’re not talking about massive differences here. Shielded transactions require more computational resources because generating zk-SNARKs privacy technology proofs is mathematically intensive. That computational work translates to higher transaction fees—usually somewhere between 0.0001 to 0.001 ZEC.

For context, that’s roughly

FAQ

What are the risks of shielded transactions?

There are legitimate risks you should understand before using shielded transactions. Regulatory risk is probably the biggest concern right now. Some exchanges and jurisdictions restrict privacy coins, though Zcash’s selective disclosure feature positions it better than pure anonymity coins.

Technical complexity risk is real too—shielded transactions are more complicated than transparent ones. This means more room for user error. If you send ZEC to the wrong shielded address, recovery options are limited.

There’s also liquidity risk—shielded pools currently have less liquidity than transparent pools, though this is improving rapidly. Some people will assume you’re hiding something if you use privacy coins, which is unfair but real.

The Zcash privacy protocol is designed to be compatible with legitimate regulatory requirements while protecting you from mass surveillance. It’s not the same as mixer services that regulators actively target. For most users, the privacy benefits outweigh these risks.

How do I initiate a shielded transaction?

First, you need a wallet that actually supports shielded transactions—not all Zcash wallets do. Look for wallets like Zashi or ZecWallet that explicitly support z-addresses (shielded) rather than just t-addresses (transparent). Once you’ve got the right wallet, you’ll generate a shielded address, which starts with “z” rather than “t”.

Next step is getting ZEC into your shielded address. You can either receive directly from another shielded address or “shield” transparent ZEC you already own. That shielding transaction itself is visible on the blockchain.

The transaction takes longer to process because zk-SNARKs privacy technology requires computational work to generate cryptographic proofs. On mobile wallets, expect 30-60 seconds; on full nodes, it’s faster. The user experience isn’t as seamless as sending Bitcoin, but it’s not rocket science either.

Can shielded transactions be tracked?

Shielded-to-shielded transactions genuinely hide sender, receiver, and amount through zero-knowledge proofs. If you receive ZEC directly into a shielded address and spend directly from it, those transactions are cryptographically private.

If you move funds from a transparent address to a shielded address, that “shielding transaction” is visible. Observers know that specific amount entered the shielded pool, even if they don’t know where it went afterward. Same thing with “de-shielding” transactions.

The best privacy comes from staying entirely within the shielded pool. There are theoretical concerns about timing analysis attacks, where sophisticated observers might correlate transaction timing patterns. These are possible but require significant resources and aren’t practical threats for most users.

The Zcash privacy protocol isn’t about making transactions untraceable to everyone. It’s about making privacy the default while preserving the ability to prove legitimacy when necessary.

What’s the difference between transparent and shielded addresses?

Zcash actually has two types of addresses. Transparent addresses (t-addresses) work basically like Bitcoin addresses—everything’s visible on the blockchain. You can see sender, receiver, and amount for any transaction.

Shielded addresses (z-addresses) are where the privacy magic happens. The transaction is verified and recorded on the blockchain, but sender, receiver, and amount remain encrypted. The network knows the transaction is valid without knowing the details—that’s the zero-knowledge part.

The two-tier system gives users choice. If you’re doing a transaction where transparency is fine or required, you can use t-addresses. For maximum privacy, you’d want to receive directly into shielded addresses and spend directly from them.

Are shielded transactions more expensive than transparent ones?

Yeah, they typically cost more, but we’re not talking about massive differences here. Shielded transactions require more computational resources because generating zk-SNARKs privacy technology proofs is mathematically intensive. That computational work translates to higher transaction fees—usually somewhere between 0.0001 to 0.001 ZEC.

For context, that’s roughly $0.05-$0.50 at current prices. Transparent transactions are cheaper, often just 0.0001 ZEC or less. There’s also a time cost—shielded transactions take longer to process, especially on mobile devices.

Your phone or computer has to generate those cryptographic proofs locally, which can take 30-60 seconds. For most use cases, the extra few cents and extra minute are worth it if you care about financial privacy.

Which wallets support full shielded transaction functionality?

Not all Zcash wallets are created equal regarding shielded address security. Zashi Wallet is probably my top recommendation right now because it supports full shielded functionality. It has this killer feature: private swaps from other cryptocurrencies directly into shielded ZEC addresses via the NEAR protocol.

ZecWallet is another solid option, offering full-node functionality for maximum privacy and control. Ywallet is good for mobile users who want full shielded support without running a full node. For hardware wallet users, Ledger devices support shielded addresses, though with some limitations compared to software solutions.

Always verify that a wallet explicitly supports z-addresses before trusting it with your private ZEC transfers. The user experience varies considerably—some wallets make shielded transactions nearly as easy as transparent ones.

What percentage of Zcash transactions are currently shielded?

The shielded pool has grown from about 18% to 23% of total ZEC supply over recent months. That might not sound dramatic, but in absolute terms, we’re talking about significant capital choosing privacy.

The recent surge in network activity shows more users actively opting into encrypted ZEC transactions rather than taking the easier transparent route. This isn’t just speculation—when people go through the extra steps to use shielded addresses, they’re demonstrating real commitment to privacy.

The goal for Zcash has always been to make shielded transactions the default rather than the exception. Some analysts predict we could see 35-40% of supply in the shielded pool by end of 2024.

How does Zcash compare to Monero for privacy?

Monero makes privacy mandatory—every transaction is private by default. You can’t choose transparency even if you wanted to. That’s maximum privacy but also creates regulatory challenges and exchange listing difficulties.

Zcash takes a different approach with optional privacy through its two-tier system. You can use transparent addresses when transparency is fine, and shielded addresses when you need privacy. Zcash’s selective disclosure feature lets you prove transaction details when legally necessary without compromising your private keys.

Zcash zero-knowledge proofs are also mathematically elegant—the technology is more sophisticated than Monero’s ring signatures in some ways. From a practical standpoint, Zcash has better exchange support and institutional backing because the optional transparency makes exchanges more comfortable.

What’s driving the recent surge in Zcash adoption?

Privacy concerns are intensifying as people realize transparent blockchains create permanent public records of every financial transaction. The IRS proposal to require Americans to report foreign crypto accounts is making people nervous about surveillance.

Institutional backing is another huge factor. Cypherpunk Technologies dropping $18 million to acquire nearly 30,000 ZEC, Winklevoss Capital’s $58.88 million position—that’s sophisticated money taking long-term positions. Binance launching a 75x leveraged perpetual contract signals they see real demand.

Technical improvements matter too—projects like zenZEC bringing Zcash privacy to Solana demonstrate cross-chain utility. The upcoming Proof-of-Stake transition and throughput improvements will make the network more practical for everyday use.

The 1,300% increase in daily transactions suggests this isn’t a temporary spike. It’s a fundamental shift in how people think about cryptocurrency privacy.

Is using Zcash legal?

Yes, using Zcash is legal in most jurisdictions, including the United States, though the regulatory landscape is evolving. Privacy isn’t illegal, and anonymous cryptocurrency payments aren’t inherently criminal any more than cash transactions are. What matters is what you do, not the tools you use.

Zcash’s architecture actually makes it more regulation-friendly than some people assume. The selective disclosure feature means you can prove transaction details to auditors, regulators, or law enforcement when legally required. That distinction matters.

Some exchanges have delisted privacy coins due to regulatory pressure, but major platforms like Binance, Coinbase, and Kraken still support ZEC. The Zcash privacy protocol is designed to be compatible with anti-money laundering requirements while preserving user privacy rights.

Using Zcash for legitimate purposes is legal and protected, but keep records of your transactions using viewing keys. The technology supports both privacy and compliance—you just need to understand how to use it appropriately.

What are the best security practices for shielded transactions?

Shielded address security requires different thinking than traditional crypto security. First, verify addresses meticulously before sending to shielded addresses. Unlike some transparent chains where mistakes might be recoverable, errors with shielded transactions can be permanent.

Second, understand that shielded transactions require more computational power. Your mobile wallet battery drains faster, transactions take longer, and you need to ensure your device isn’t compromised. Third, be aware of linkability risks when moving between transparent and shielded pools.

Consider maintaining multiple shielded addresses for different purposes. Backup strategies are critical—losing access to a shielded wallet is potentially catastrophic. Write down seed phrases, store them securely offline, and test your backup recovery process.

Consider using viewing keys for situations where you need to share transaction history with accountants or auditors. Keep your wallet software updated—updates often include security improvements.

Can I use shielded transactions on exchanges?

Support for shielded ZEC transactions on exchanges is inconsistent and limited. Most exchanges support ZEC trading, but many only support deposits and withdrawals to transparent addresses, not shielded ones.

Some exchanges that do support shielded withdrawals include Coinbase, Gemini, and a few others, but you need to verify current support. Binance lists ZEC and recently launched leveraged perpetual contracts, but their shielded address support for withdrawals varies by region.

Here’s the workaround: withdraw to a transparent address you control, then immediately shield those funds. The better long-term approach is using decentralized exchanges or privacy-preserving swap protocols like what Zashi Wallet offers.

Exchanges face regulatory pressure around privacy coins, which creates this awkward situation where they support ZEC as a tradable asset but limit the privacy features. Always check an exchange’s specific deposit/withdrawal policies before assuming full shielded support.

.05-

FAQ

What are the risks of shielded transactions?

There are legitimate risks you should understand before using shielded transactions. Regulatory risk is probably the biggest concern right now. Some exchanges and jurisdictions restrict privacy coins, though Zcash’s selective disclosure feature positions it better than pure anonymity coins.

Technical complexity risk is real too—shielded transactions are more complicated than transparent ones. This means more room for user error. If you send ZEC to the wrong shielded address, recovery options are limited.